vermont state tax rate

6 - 7 Property tax. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

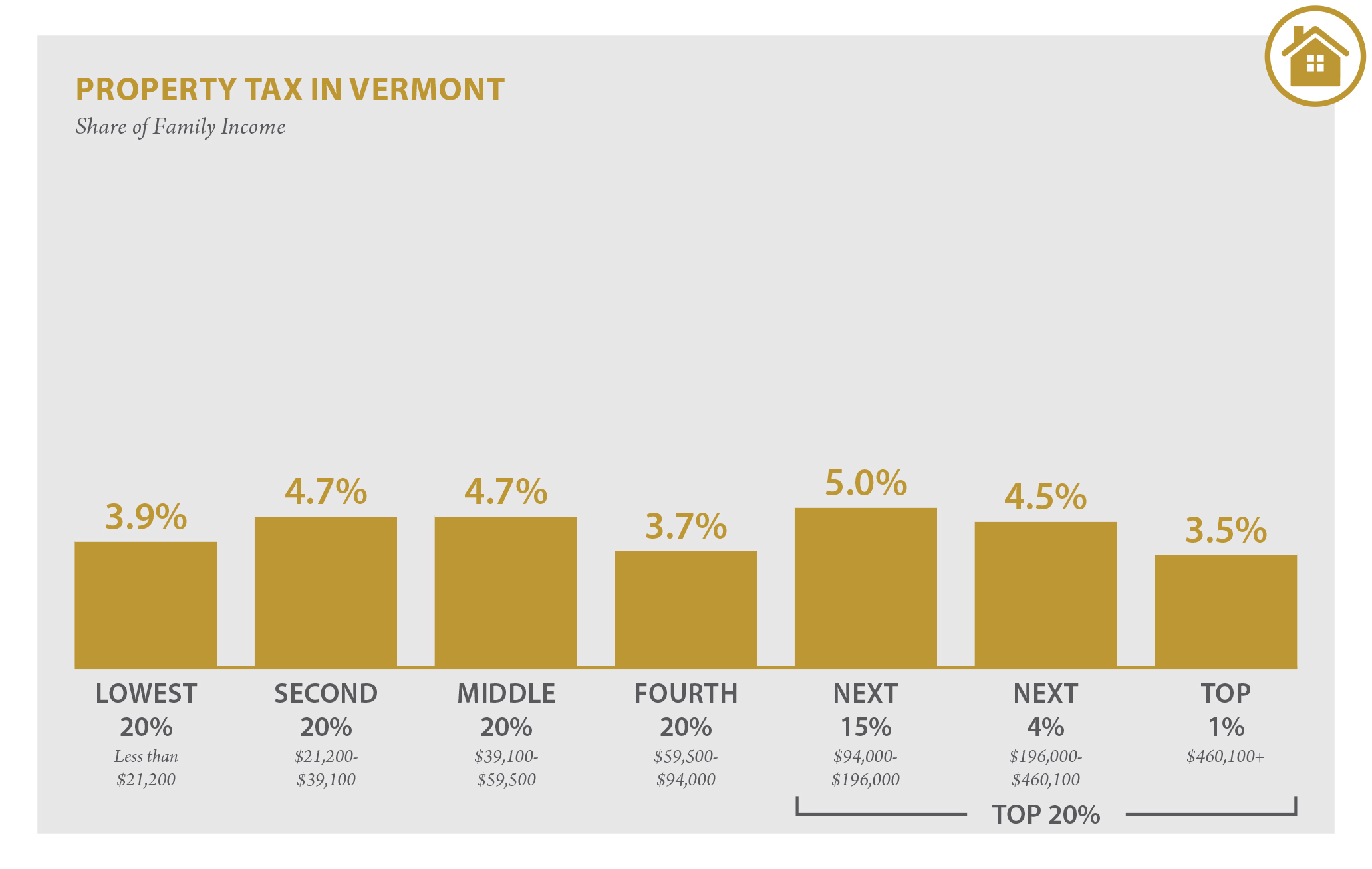

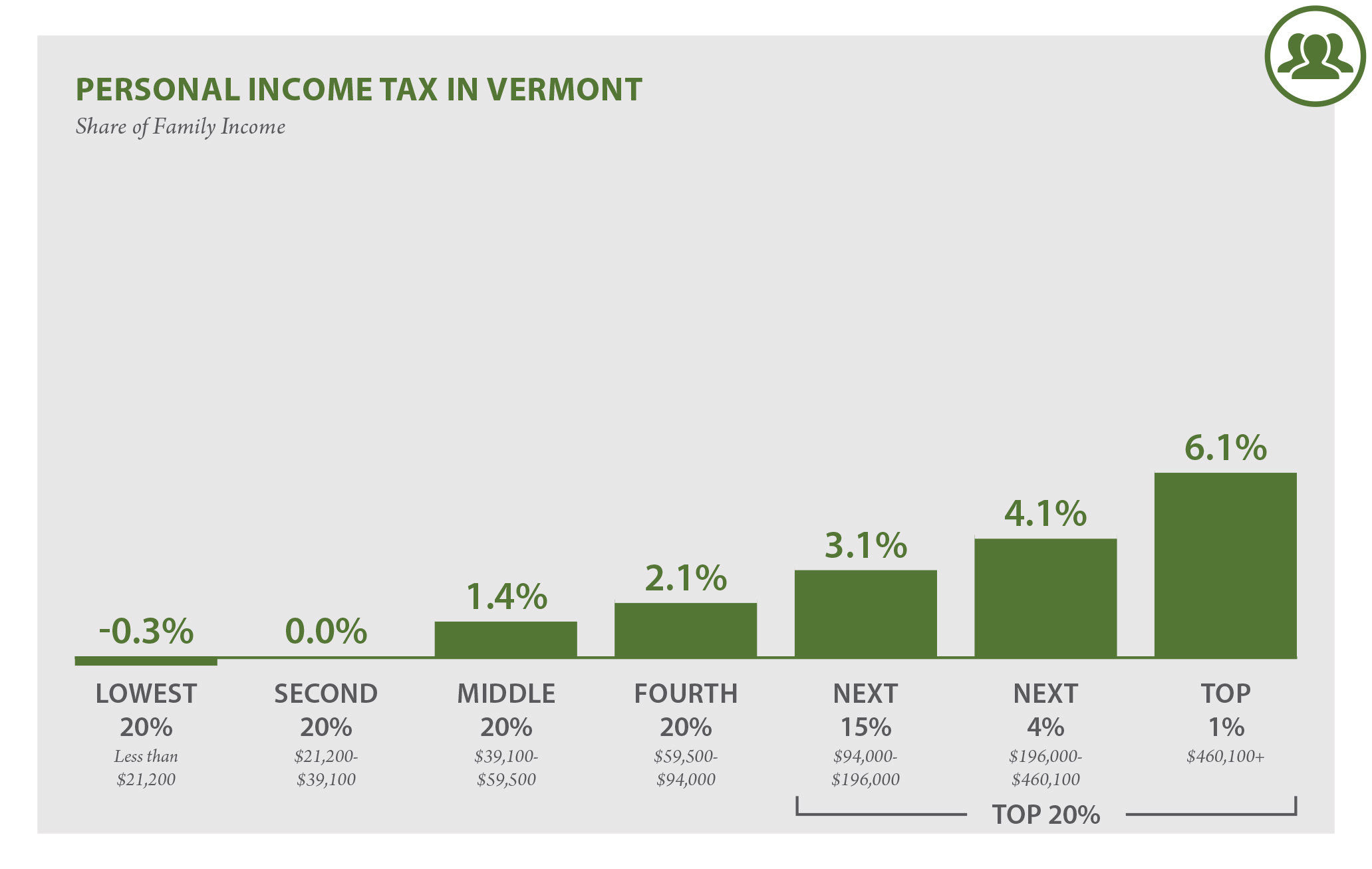

Vermont Who Pays 6th Edition Itep

2021 VT Tax Tables.

. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1There are a total of 155 local tax jurisdictions across the state collecting an. Now that were done with federal payroll taxes lets look at Vermont state income taxes. Vermonts tax system ranks.

Tax rate of 335 on the first 40350 of taxable income. Overall state tax. Tax rate of 66 on taxable income between 40351 and.

Other local-level tax rates in the state of Vermont are quite. The Vermont VT state sales tax rate is currently 6. 6 Vermont Sales Tax Schedule.

Local Option Meals and Rooms Tax. 335 - 875 Sales tax. 9 Vermont Meals Rooms Tax Schedule.

The annual rate for the overpayment and underpayment of tax for 2022 will be 325. Depending on local municipalities the total tax rate can be as high as 7. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

1210 cents per gallon of regular gasoline 28 cents per gallon of. Vermont charges a progressive income tax broken down into four tax brackets. Your average tax rate is 1198 and your marginal tax rate is 22.

Vermont is ranked 3rd of the 50. As you can see your Vermont income is taxed at different rates within the given tax brackets. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate.

Local Option Alcoholic Beverage Tax. 31 rows The state sales tax rate in Vermont is 6000. This marginal tax rate means that.

For single taxpayers living and working in the state of Vermont. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Tax Rates and Charts.

The Vermont Department of Revenue is responsible for publishing the latest Vermont State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in. 186 average effective rate Gas tax. With local taxes the total sales tax rate is between 6000 and 7000.

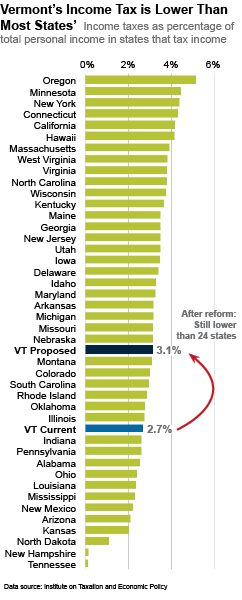

Currently combined sales tax rates in Vermont range from 6 to 7 depending on the location of the sale. Adjusted gross income AGI filing status exemptions and reporting town are informational and not. Vermonts income tax rates are assessed over 5 tax brackets.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Vermont has recent rate changes Fri Jan 01. This rate will be effective beginning January 1 2022 and apply to interest that accrues in calendar year.

Source data is information provided on individual tax returns. 68 on taxable income between 37451 and 90750. Provided the state does not have any outstanding Title XII.

As a business owner selling taxable goods or services you act as an agent of the. Net income 10000 or less 60 rate or minimum tax based on Vermont gross receipts net income 25001 and over 1650 plus 850 of excess over 25000. The 850 top marginal.

355 on the first 37450 of taxable income. Vermonts median income is 62088 per year so the median yearly property tax paid by Vermont residents amounts to approximately of their yearly income. Location is everything if you want to save a few income tax dollars.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as. Taxes in Vermont Income tax.

Vermont Has The Capacity To Avoid 2016 Budget Cuts Public Assets Institute

Vermont Department Of Taxes Notice Of Changes Sample 1

Vermont State Tax Tables 2021 Us Icalculator

State Withholding Tax Table Maintenance Vermont W Hx03

Vermont Income Tax Vt State Tax Calculator Community Tax

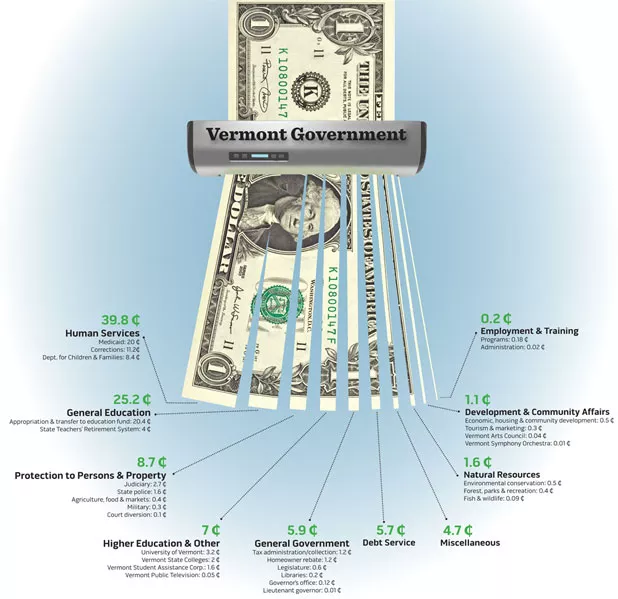

Where Do Your Vermont Income Tax Dollars Go Politics Seven Days Vermont S Independent Voice

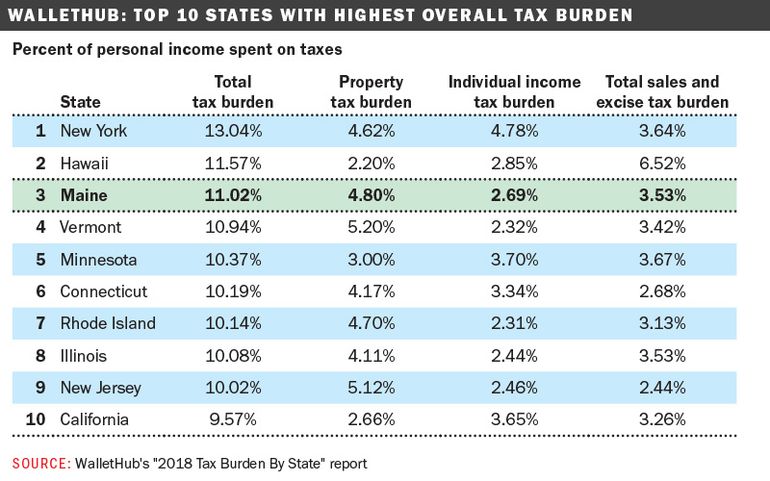

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Vermont Income Tax Vt State Tax Calculator Community Tax

Is Vermont Really So Expensive Vermont Public

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Where S My Refund Vermont H R Block

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont Who Pays 6th Edition Itep

States With The Highest Lowest Tax Rates